Helcim

A research memo on a PayFac birthed in the Prairies

Helcim: From an ISO to a Payment Facilitator

Nic Beique founded Helcim in 2007 as an Independent Sales Organization (ISO)1. Helcim got a license from Elavon to sell merchant acquiring services to small and medium-sized businesses (SMBs) in the US and Canada. The payments acceptance reseller program allowed Helcim to control pricing and manage customer experience, and it ended the first year with 49 customers2. Helcim grew over the years and currently serves more than 6500 customers3. It was profitably bootstrapped till March 2022 when it raised $16 million in a Series A round4 5.

Helcim rebranded as a Payment Facilitator (PayFac) in June 20206. The relaunch was branded Helcim 2.0. The integrated payments stack was built in-house over a period of 3 years with cash flow that was generated from the ISO business. The leadership team was convinced they could amalgamate offering cheap pricing, seamless onboarding, excellent customer support delivery and honest relationship with merchants to build the world’s most loved payments company.

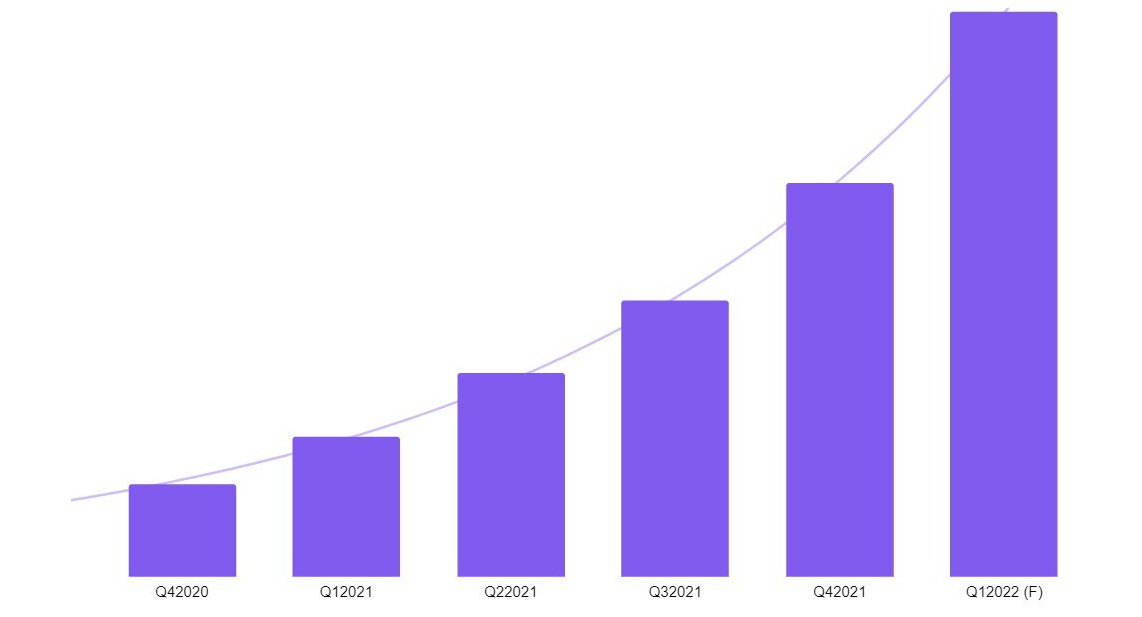

Image A - Helcim’s Merchant Growth By Quarter

The relaunch as a PayFac coincided with the COVID lockdown, which provided a tailwind that accelerated Helcim’s growth; they had a 400% year-on-year increase in merchant base in 2021. Ultimately, Helcim aims to be the one-stop platform for SMBs to accept payments affordably, grow their businesses with in-built software tools and access financial services. The management confirmed that a chunk of the recent equity raise will be used to grow Helcim’s talent base to over 150 employees by the end of 2022 to continue on the journey of becoming the preferred payments acceptance provider for SMBs in the US and Canada.

Product

Comprehensive Payments System

Helcim’s core product is a payments stack with omnichannel capabilities; merchants are able to offer a unified commerce experience to customers across different touchpoints.

Merchants can collect card payments on their websites via a secured gateway.

Payments can be received in person through a POS terminal. Helcim’s branded Card Reader allows shoppers to dip and tap their cards to pay for transactions.

Customers can also pay for transactions from their bank accounts via ACH and ETF/PAD.

Similar to the online gateway, merchants can use Helcim’s virtual terminal to input customers’ card information to bill them on a computer, tablet or phone.

Recurring payments feature for subscriptions is also hardwired into Helcim’s stack.

Helcim built the infrastructures required to function as a PayFac but maintains its partnership with Elavon which serves as its acquirer to the card networks in the US and Canada7. Merchants can sign up to use Helcim on the company’s website using a computer, tablet or mobile device. The process can take as little as 5 min after a merchant fills in information about their business, address and contact details. An account is ready to be used as soon as registration is completed. This is a contrast with what is obtainable when onboarding to use legacy systems for payments acceptance. The procedure is often complex, time-consuming, costly and better suited for large businesses.

As a PayFac, Helcim manages several relationships, maintains multiple systems and, overall, abstracts away the complexity of payments acceptance for SMBs, allowing them to focus on other important activities.

Image B - A PayFac Multiple Relationships and Managed Systems

Commerce Software Suite

Helcim offers commerce-enhancing software that complements its payments system. Merchants have access to the available products within their accounts.

Invoicing - Merchants can create unlimited invoices and send them to customers via email or text messages. Invoices can be customized and are integrated with a ‘Pay Now’ button, which allows a smooth experience for customers to directly remit pending balances.

Product & Inventory Manager - The inventory management backend syncs with multiple sales channels such as an online store and retail location to track merchandise. Merchants can generate insightful reports on inventories and get alerted when a stock level is low. The product manager enables merchants to create product variants and organize them by categories, brands and collections. This is particularly useful for merchants that use Helcim’s online store product.

Customer Manager - Merchants can save customers’ profiles, store payment details in a vault, track prior orders and review purchasing habits.

Online Store - Merchants can create a functional, fully hosted and branded website in their Helcim accounts. Available settings include shipping, tax calculation, domain name customization, blog, order management, etc.

Helcim also offers third-party integration to accounting software, shopping carts and billing systems. In the long run, Helcim is building products to accomplish the objective of becoming an all-in-one merchant platform.

Business Model

There are two (2) sources of revenue for Helcim. First, the company sells its card reader to SMBs. It retails at $109 and CAD139 in the US and Canada respectively, shipping inclusive. Second, it charges variable rates on transactions processed by merchants. The rates are also tiered, so merchants with high gross payment volume get discounts.

Image C - Helcim’s Payments Chart

Helcim charges 0.5% of a transaction amount + 25¢ for ACH and EFT/PAD. It charges $5 per return/reject.

As a card acceptance provider, Helcim typically charges a merchant discount rate (MDR) or merchant service charge (MSC) on every transaction. In other words, the amount that is credited to merchants for a transaction is net of applicable fees. An MDR comprises an interchange amount paid to cardholders’ banks, a network assessment fee that is remitted to the card networks and the acquiring markup (AM) that is kept by Helcim8. Elavon being the acquirer will have to be compensated for its role in payments processing. Hence, it is expected that Helcim shares the AM with the company.

Helcim doesn’t monetize its software products, but that could change in the future.

Market

Customer and Market Size

Helcim serves the small and medium-sized enterprise segment in the US and Canada. Helcim’s history as a reseller of acquiring services to brick and mortar businesses has influenced its primary focus on traditional businesses such as professional services, clinics and speciality stores. Some of the customers that currently use Helcim’s payments products include a custom broker, an auto-mechanic shop, a bicycle retailer, a home inspection service and an embassy.

In the US and Canada, the size of Helcim’s target market is approximately 20 million and 1.2 million SMBs, respectively 9 10. The gross receipt of the serviceable SMBs in just the US is $1.8 trillion. With Helcim servicing less than ten thousand (10K) merchants and processing gross payments volume of about $2.5 billion, it is apparent that the company operates in a lucrative industry with headroom for growth.

Competition

Helcim’s CEO mentioned in a podcast that the company is focused on acquiring SMBs that are currently served by legacy payment processors. The copy and creatives of some ads in the company’s Facebook library buttress this view. Specifically, there are ads that compare what Helcim offers with a legacy provider - Moneris11. Helcim also competes with other modern PayFacs and there is an awareness of this; there are content and performance marketing collaterals that outline Helcim’s superiority over Square12.

Taking a step back from the management’s view of the competitive landscape, here is a list of some of Helcim’s competitors:

Legacy payment providers - Moneris, Chase Paymentech, TD solutions etc.

PayFacs with a focus on brick & mortar businesses - Square, Lightspeed etc.

Vertical software providers with integrated payments solutions - Shopify, Toast etc

PayFacs suited for digital-first businesses - PayPal, Stripe etc.

Helcim’s differentiation strategy in the marketplace is predicated on three (3) pillars:

Affordable Pricing - Helcim 2.0 offers a competitive interchange plus pricing to customers. Nic opined that building the comprehensive payments stack from scratch allows Helcim to offer aggressive pricing to SMBs while still maintaining a good margin to grow the business.

Customer Service - Helcim prides itself in providing exceptional customer service. This is founded on treating support specialists as rock stars and developing their competence so they are equipped to provide exceptional support to SMBs. Helcim views customer service as the touchpoint of the brand and it is not outsourced.

Digital First Experience - Merchants are able to instantly sign up to use Helcim’s payments infrastructure without a contract and paperwork. Helcim intends to make onboarding seamless.

Key Opportunities

Growing Market

Some factors that are fuelling a growing market include:

Digitization of payments method - In a 2021 trend report, Payments Canada disclosed that cash transactions had reduced by 44% from 2015 to 2020, replaced by debit and credit card payments which now constitute 28% and 30% of total payments volume in 2020 13. A similar trend is observable in the US14. The seismic change in consumer preference for digital payments methods, accelerated by the pandemic, is great for Helcim. Higher electronic payment volume at the point of sale is favorable for payments processors.

eCommerce volume as a share of Retail - While COVID-induced accelerated growth in eCommerce share of total retail has waned, online shopping is still projected to continue to grow, reaching 24% of commerce by 2026 (from 19% in 2021)15. Payments processors with omnichannel abilities stand to benefit from this shift. For instance, a customer of Helcim that operates only offline and later decides to sell via their branded website would most likely prefer to maintain a single backend and use the gateway provided by Helcim.

Altogether, tailwinds that engender an increase in the size of SMBs in the US and Canada, and digital payments volume are favorable for Helcim.

Diversification into Adjacent Financial Services

Helcim could expand its revenue mix by developing proximate financial services to the acceptance of the payments for its target market. The services could help attract new customers and increase the density of revenue from its existing users.

A potential product is expense management and corporate cards platform. The North American corporate cards market size was estimated at $14.1 billion in 2020 and is expected to grow due to businesses' increased disposition toward card payments for better spending visibility, control and management of working capital16. By building a card product, Helcim could earn revenue from interchange fees, which is typically a larger percentage of MDR than the acquirer markup.

Furthermore, Helcim could evolve to provide commercial banking services. With access to sales data, obsession with customers' experience and digital enablement, it could offer a superior lending service to its current customer base and subsequently other SMBs. Multiple publications have confirmed over a trillion dollars in supply-demand financing imbalance for SMBs, so there is an attractive opportunity in the space17. Also, a checking account for SMBs with commercial cards for business payments provides another source of revenue from interchange fees.

Key Risks

Competition

Payments acquiring, at its heart, is a scale-oriented business where economics of scale drives profitability18. Consequently, the acquiring markets in the US and Canada are concentrated, with few legacy providers processing over 80% of payment transactions.

As a PayFac without an acquiring license, Helcim provides a front-end processor for payments’ acceptance, and that in itself also requires a large transaction volume for the business economics to make sense. But it has to directly compete with other PayFacs with deep resources (talents, capital and technology depth), first mover advantage and solid branding with mindshare. Hence, Helcim has its work cut out with competition in the industry and there is a potential risk to the long-term sustainability of the business if it is not able to acquire merchants at a fast clip.

Monetization

Since its inception, Helcim has monetized its payments processing service via an interchange plus pricing. In the previous model as a reseller, it also earned revenue by charging other fees, all of which have been abolished after the relaunch as a PayFac. Fixed charges represent one-third of SMBs’ monthly payment processing fees, so modern PayFacs that eschew levying flat monthly fee is beneficial for the target market. However, unlike Helcim, other PayFacs generally use a flat rate pricing on transactions which has a better margin than interchange plus and Helcim admitted to this on its website. Furthermore, PayFacs earn additional income from software products they provide to merchants, while Helcim doesn’t.

Image D - Helcim's Revenue Contrast as a Reseller and PayFac

All in all, Helcim has primarily positioned its brand as a low-cost payment acceptance provider with honest and transparent pricing. It is also not illogical to conclude that Helcim has one of the lowest take rates in the market.

If the company decides to improve its margin in the future - and a low-hanging fruit is monetizing its merchant tools, it will be deviating from its one of differentiation strategies of low-cost offering and that could possibly lead to a disgruntled customer base that might be accustomed to cheap pricing. Ultimately, Helcim must be prepped to manage any potential fallout if it resolves to suspend waivers and collect fees for products it currently offers for free.

Conclusion

Helcim is an intriguing payments startup that is operating in a lucrative and competitive industry. The series A fundraise of $16 million as the first equity investment does indicate that the company is trending in the right direction. The resilience and capital efficiency of the management team in building a PayFac tech architecture with retained earnings from the ISO business and the founder’s experience in the payments scene are shining points for the business. If Helcim continues to successfully acquire customers, build new products and effectively monetize, it has an opportunity to thrive in the payments space.

Block’s 2022 investor day presentation on Square's market opportunity (PDF)

The estimated size of SMBs in the US presented in the document is assumed to be the total addressable market for Helcim since both companies compete in the same space.